Intel reported a surprisingly strong set of Q2 earnings last week. Revenue came in at $12.9 billion, above expectations, and they turned a profit of $0.36 per share, while the Street was expecting them to lose money. The company also guided Q3 EPS above estimates, while their revenue guide was a bit light.

With a guidance like that, most companies would have faced a mixed reaction from the stock market, but Intel is not a normal company in normal times. Consequently, their stock soared in after-hours trading. Despite this positive news, it's important to remember that Intel is not out of the woods yet.

Editor's Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

Our thesis on Intel holds that the company faces three sequential challenges: rectifying their manufacturing process, reigniting their product portfolio, and subsequently populating their fabs with Intel Foundry Services (IFS).

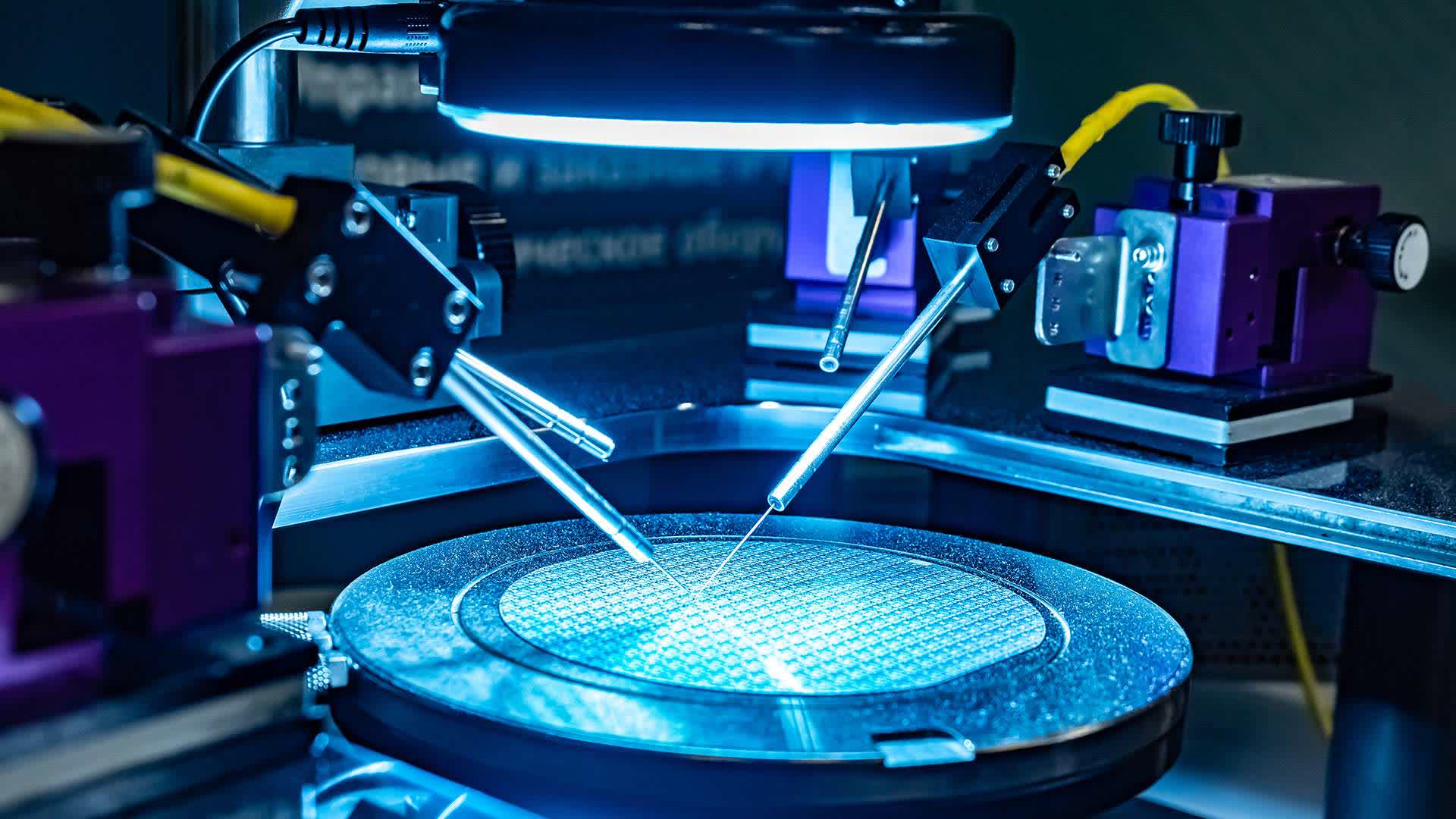

The Intel team gave a pretty solid update on that first challenge. Their process plan – 5 nodes in 4 years – is on track. Their first EUV node is now entering production, and the crucial 20A node seems ready for imminent production. This is significant progress for the company, addressing a key existential issue. Although it's still two years away before we can conclusively say they've achieved these 5 nodes, the management's confident tone on the call was noteworthy, suggestive of a return to Intel's old form. As we've consistently stated, the company undoubtedly has the talent to accomplish its goals, which now seems to be finally manifesting.

Of course, this leaves the two remaining challenges. It is premature to discuss IFS at this stage. While we believe good progress is being made, it will be several years before we can begin to evaluate Intel's performance in providing customer services to other companies. We expect to hear announcements this year about customer signings, but we must view these as early endorsements. None of the major fabless chip companies will commit substantial volume to IFS until their manufacturing processes are fully refined, which likely won't happen until later this decade. Thus, we regard progress on challenge #3 as initial, but it's too early for a final assessment.

This brings us to the company's next challenge – can its products compete? Here, we are left with more questions than answers. Honestly, we heard more concerning than comforting comments during the call. We now return to the traditional analysis of company statements, reading the tea leaves and interpreting subtle hints of their comments.

Intel was eager to assure investors that demand for their products was stabilizing. However, this 'normal' situation includes a myriad of reasons why it appears weak. The surge in China's demand hasn't materialized. Inventory has significantly improved, yet remains high in the channel. Our latest favorite phrase, "demand should recover in the second half of 2023", is one we've heard from many companies lately.

Most worrying for us was their assertion that the demand for AI semiconductors is displacing demand for other chips. We are confident that this is a misconception. There's indeed a short-term issue as customers shift their remaining 2023 budgets to accommodate AI demand, but this is a temporary situation. We have substantial data suggesting that budgets are actually increasing. While Intel's management might be hinting at something similar, their Data Center segment continues to decline and lose money. Intel's latest financials have many moving parts, and it seems that the company's core CPU products are still struggling. Nothing in their outlook provided us much confidence that this situation would soon change.

However, we believe Intel appears to be in a significantly improved position. They still face a mountain of challenges, but they're beginning to demonstrate their capability to overcome them.