The big picture: If there's one company stuck bang in the middle of the intensifying US-China chip wars, it's ASML – the Dutch semiconductor equipment giant that supplies cutting-edge lithography tech to all the major players. The company's recently departed CEO has just shared his insights on this complex geopolitical landscape.

In a recent radio interview with Dutch radio station BNR, Peter Wennink didn't mince words on the US trade restrictions targeting China's chip ambitions. Wennink, who stepped down as ASML's chief in April after a decade at the helm, claims that the issue is driven more by ideology than by concrete evidence.

"These kinds of discussions are not being conducted on the basis of facts or content or numbers or data but on the basis of ideology," Wennink stated.

Under Wennink's leadership, ASML morphed into Europe's largest tech firm. A big part of that success was fueled by China, which became ASML's second biggest market after Taiwan as Beijing doubled down on semiconductor self-sufficiency.

But the US has steadily clamped down on what chip tech can flow into China, citing national security concerns. At the start of this year, ASML announced that it would no longer be able to ship its NXT:2050i and NXT:2100i lithography systems to China. The latest restrictions this April even barred the company from servicing some of its equipment previously sold to buyers in the country.

For a company with three decades of dealing with China, these limits create serious headaches. As Wennink puts it, "You also have obligations" to long-term Chinese staff and customers. Therefore, under his leadership, he tried to strike a delicate balance between the two nations, claiming to lobby against overly restrictive export controls, while also pushing back when China infringed on ASML's IP rights.

Due to his more neutral approach, Wennink suggested that in Washington, there may have been a perception that he was a friend of China. But he dismissed this notion, asserting that his allegiance lies with his customers, suppliers, employees, and shareholders.

Wennink predicts the chip Cold War will rumble on for years or even decades. "This is going to go on for a while," he warned.

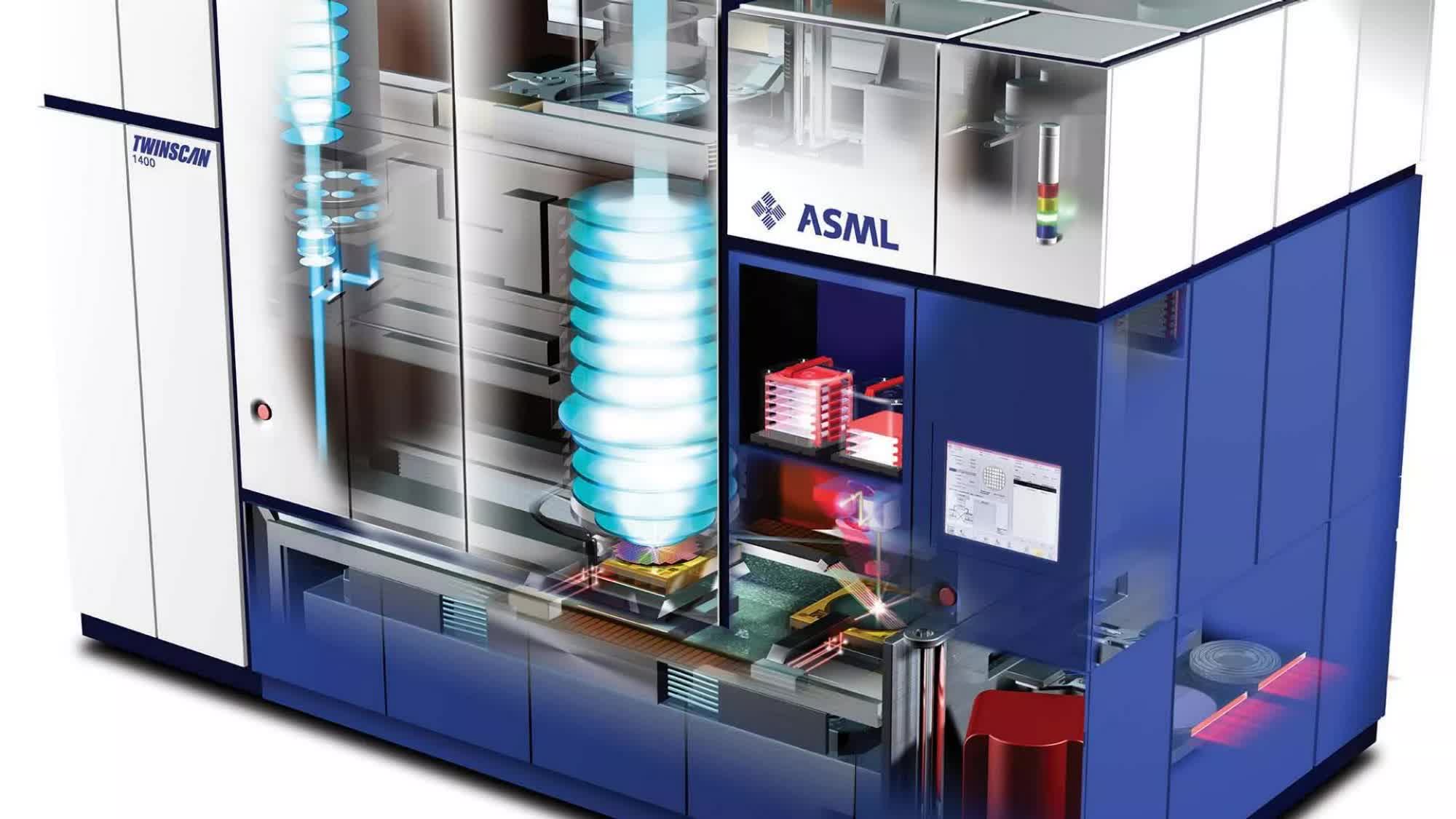

ASML certainly has a vested interest in keeping the peace. The company's extreme ultraviolet (EUV) lithography systems are critical for cutting-edge chip manufacturing at all the industry's leading players, including TSMC, Samsung, and Intel. EUV is essential for squeezing more transistors onto silicon at 7nm and denser nodes.