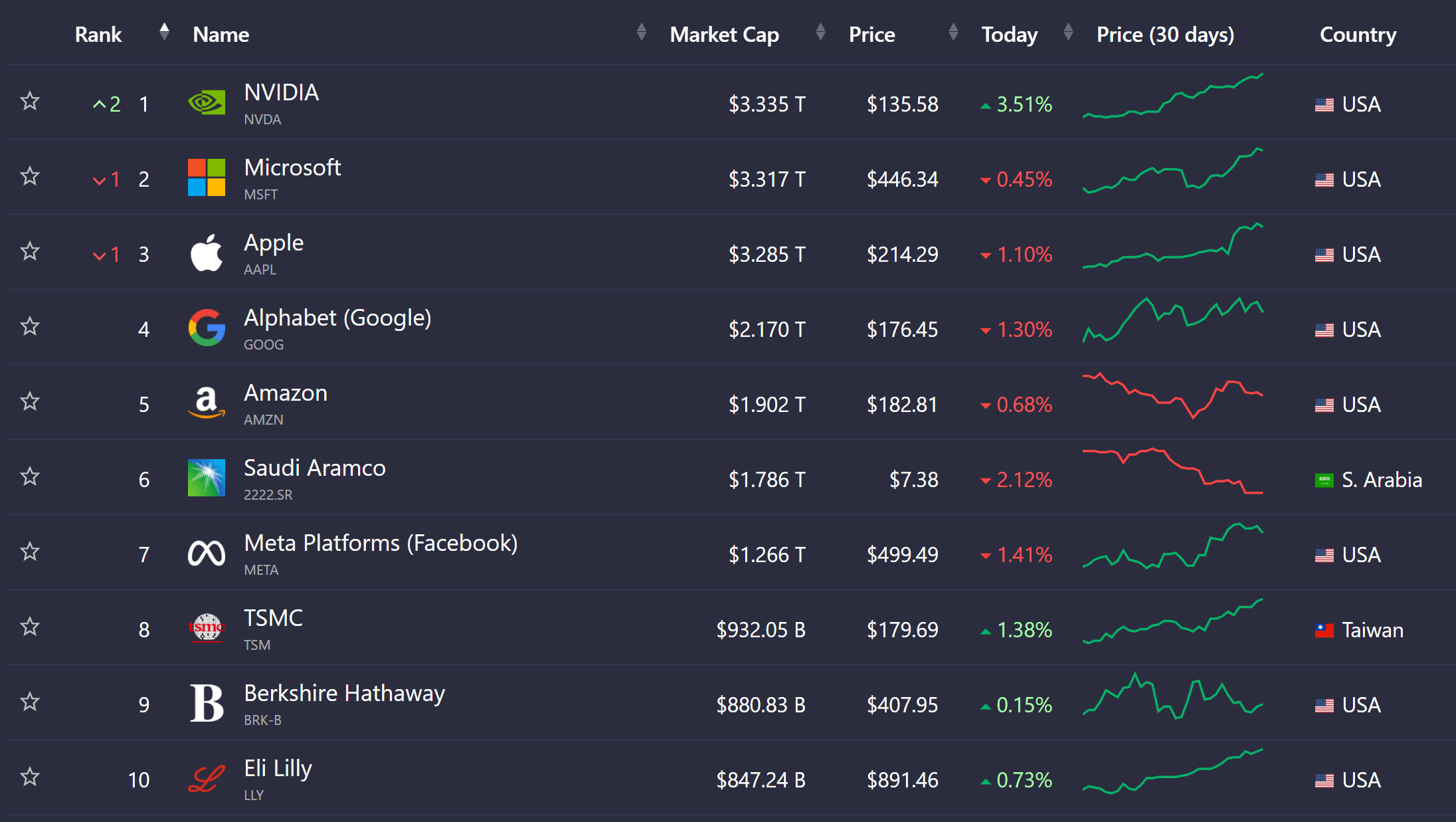

Why it matters: Nvidia's role as the provider of most of the advanced hardware powering the AI boom has seen it become the second most-valuable company in the world. Team Green's market cap had surpassed the $3 trillion mark earlier this month but after a stock split and subsequent increases on its price, it's now valued at over $3.34 trillion, putting it just above Microsoft and Apple.

Nvidia's shares are up another 3.5% today, closing at $135.58. The company's share price has increased by more than 3,400% over the past five years and 181% this year alone.

With a market cap of $3.34 trillion, Nvidia has joined the very exclusive $3 trillion club alongside Apple ($3.29 trillion) and Microsoft ($3.32 trillion). Bloomberg notes that the last time Nvidia was worth more than Apple was in 2002, five years before the first iPhone was released. Both companies' market valuations were less than $10 billion at the time.

What's especially impressive is that Nvidia only passed the $2 trillion valuation milestone in February 2024, less than a year after it hit $1 trillion, in May 2023. It means the company's market value has skyrocketed another $1 trillion in just over three months.

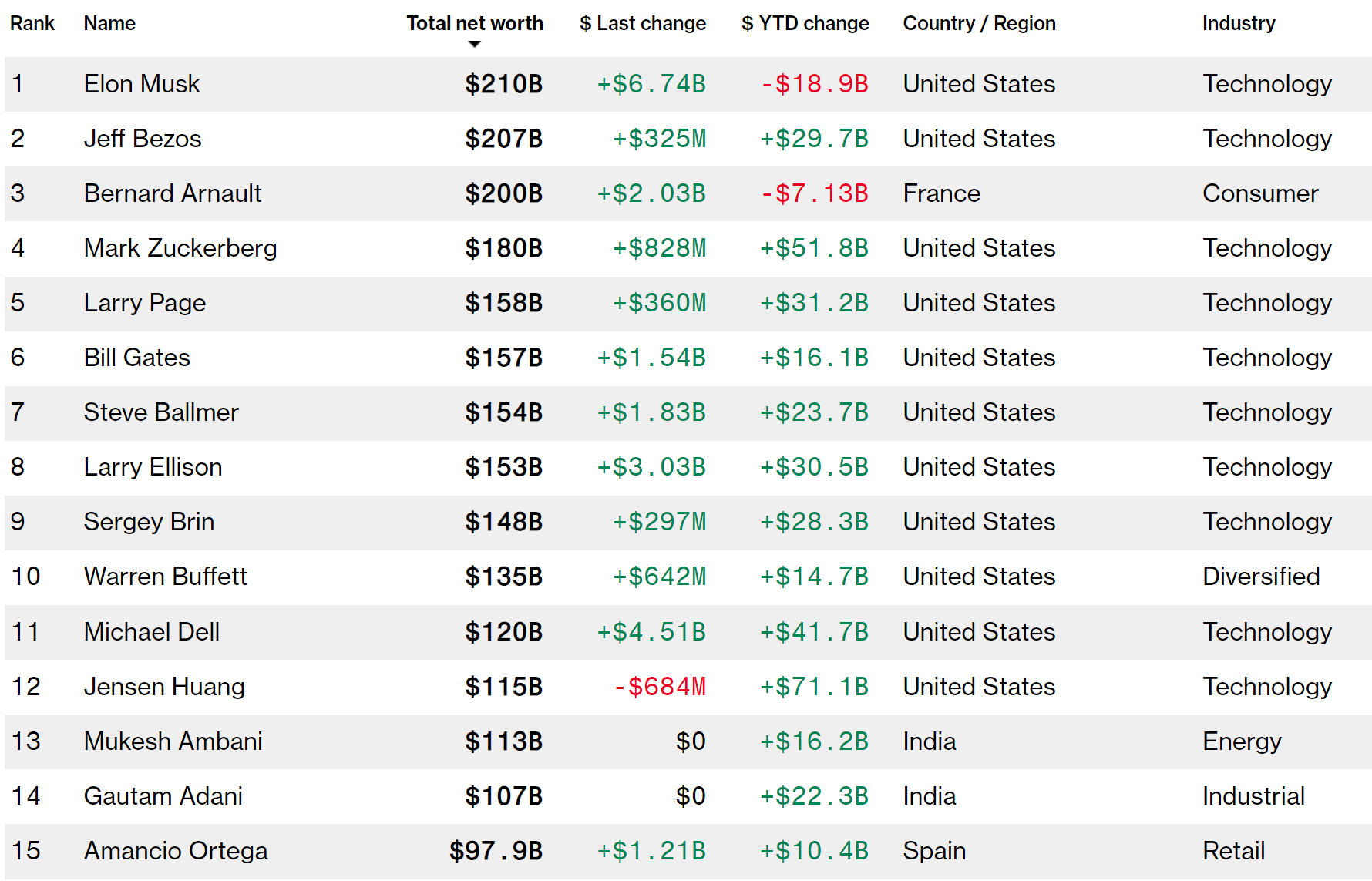

Nvidia's soaring share price has seen CEO Jensen Huang, who owns 3.79% of the company, continue to rise up the Bloomberg Billionaire's Index. He sat in 18th place in May with a net worth of $80.5 billion. Today, Huang is in 12th position with a fortune of $115 billion.

The enormous demand for Nvidia's GPUs from companies going all-in on AI (i.e., all of them) saw its first-quarter sales hit $26 billion, more than three times what it earned during the same period a year earlier. In the high-end AI chip market, it's estimated that Nvidia holds a market share of between 70% to 95%.

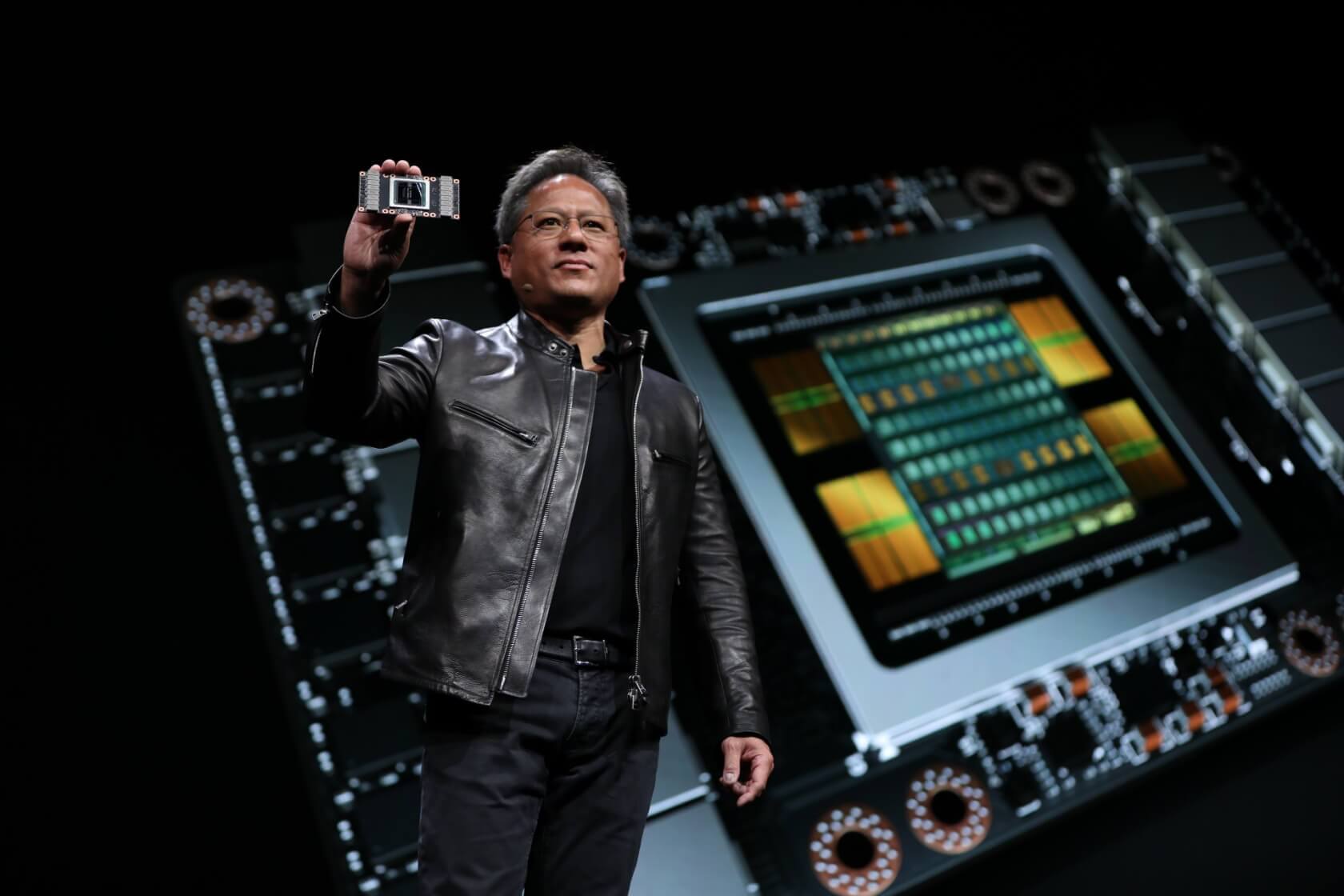

Huang announced at Computex that Nvidia's roadmap for its core GPUs is taking on an accelerated pace. While big architectural changes are likely to continue at a rate of every two years, Nvidia is now moving to make important product enhancements every year. Blackwell Ultra is set to arrive next year, followed by Rubin in 2026 and Rubin Ultra in 2027.