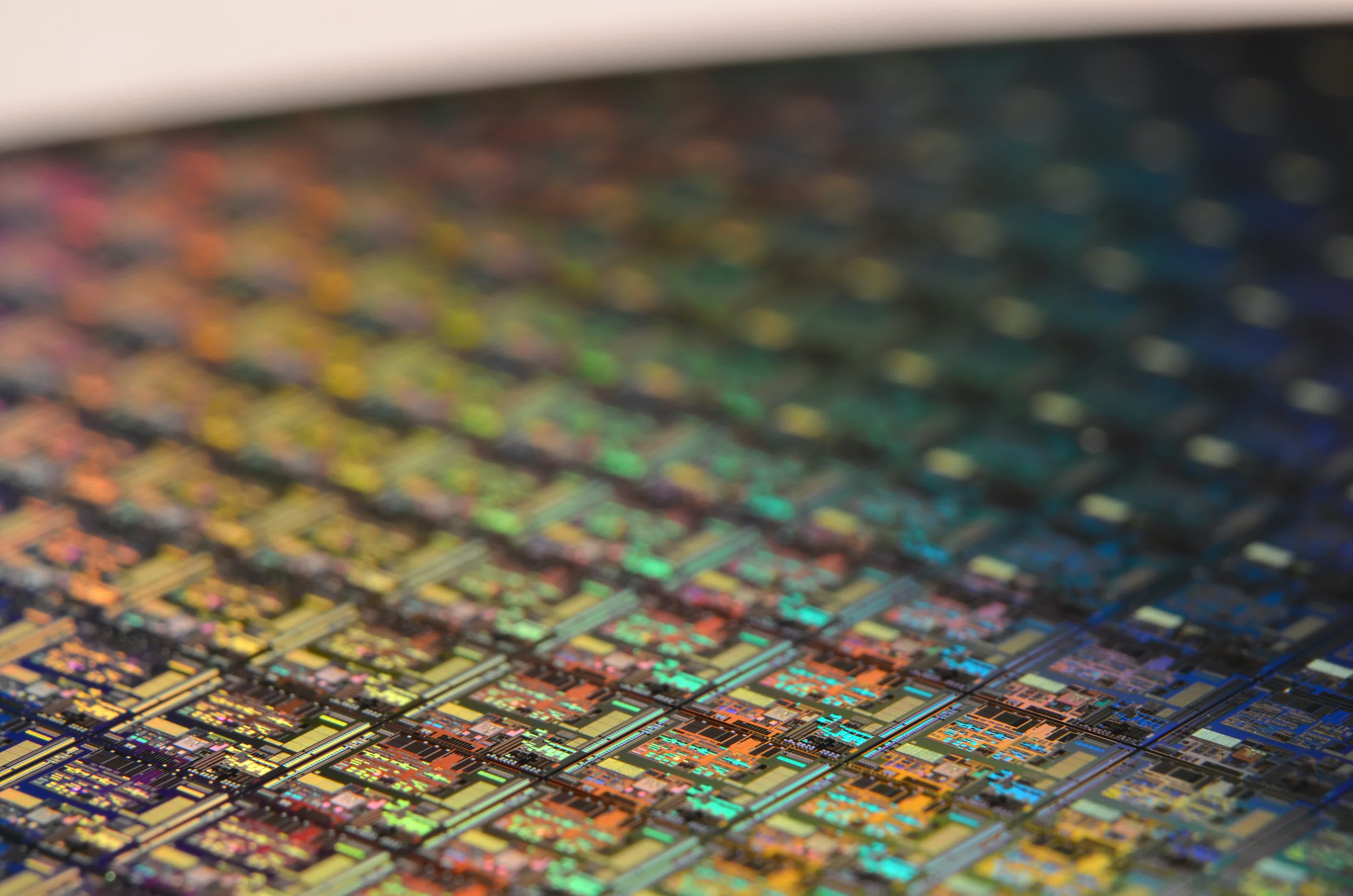

The big picture: South Korean tech giants like Samsung and SK Hynix have dominated memory manufacturing for decades. However, the country's president thinks the competition in the processor market, where Taiwan's TSMC looms large, has recently become significantly more critical. A new support package aims to increase Korea's competitiveness across the chip industry.

South Korean President Yoon Suk Yeol recently unveiled a $19 billion support program to boost the country's semiconductor industry. One of the areas the President stressed when outlining the package concerns processors, a sector where Korean companies currently lag behind industry leader TSMC.

President Yoon acknowledged that South Korea has dominated memory production for 30 years but also noted that "all-out national warfare" has emerged to produce semiconductors for CPUs and GPUs. Countries like the US and China have intensified their focus on semiconductors since the pandemic revealed the fragility of tech supply chains. The AI boom has also made CPUs and GPUs more crucial. Recent earthquakes in Taiwan, where TSMC makes the most advanced chips, have also raised concerns.

Although the Korean financial package doesn't include direct subsidies like the recent US CHPS Act, it will offer tax credits and support for infrastructure and R&D. To address concerns that the support will mainly benefit large companies, Yoon stated that 70 percent of affected businesses will be small or medium-sized.

For example, the program will support the establishment of a mini-fab to help fabless companies design and prototype chips. Yoon noted that Korea's fabless market share currently hovers around one percent and has struggled to close the gap with TSMC.

Finance Minister and Deputy Prime Minister Choi Sang-mok addressed the concern surrounding the lack of direct subsidies by highlighting the differences between how various countries support their chip industries. Without directly mentioning the American CHIPS Act, Choi said direct subsidies are better suited to countries trying to build manufacturing capacity from scratch. This necessity is mitigated in South Korea and Taiwan since they already possess robust facilities.

In related news, Samsung has denied a recent Reuters report suggesting that its new HBM3 memory chips failed tests for Nvidia's upcoming AI GPUs due to excessive heat and power consumption. Reuters cited multiple sources, but Nvidia hasn't publicly commented on the claim. Samsung's Korean rival, HK Hynix, plans to launch HBME3 memory this year and progress to HBM4 in 2026.